You: I save money every month.

Me: How much do you save each month?

You : Well, it depends on what I have left after I pay all my bills and other expenses.

I’m going to go out on a limb and say this may resonate with you because I see it with my clients all the time. They want to save consistently but, too often, they pay their bills and fund their lifestyle then save what few dollars they have left – if there’s anything left at all.

That’s the reality but what my clients – and you – would love is a solution that creates consistent savings that does not depend on your bills and other expenses.

I want to help you find that solution and get serious about saving money. I want it to be something you do consistently because when saving becomes a consistent habit, it means you’ll be able to build your emergency fund, save for a downpayment on a home or pay cash for a vacation.

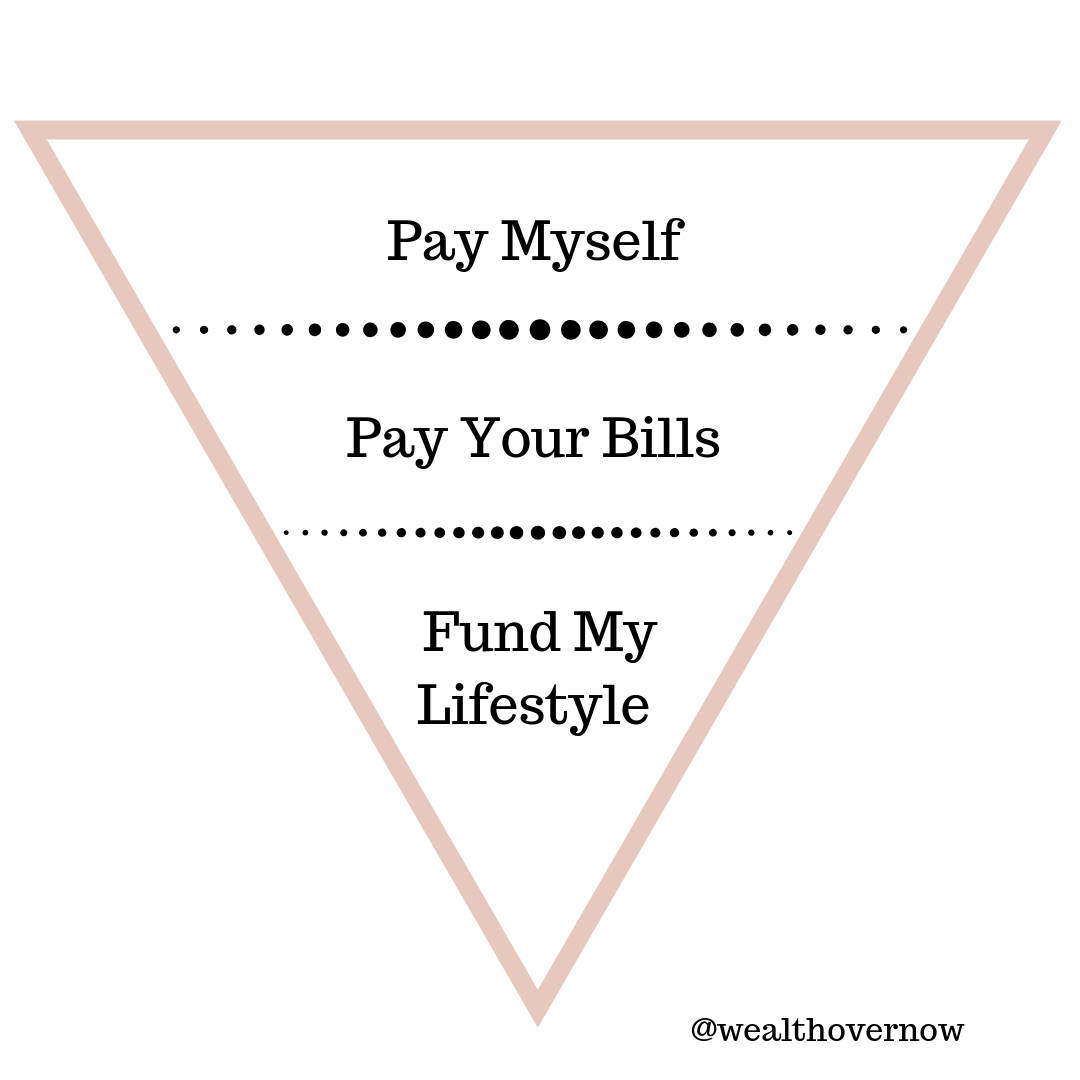

So here’s how you can get serious about saving consistently. You have to pay yourself first! Paying yourself first simply means that the first thing you do with EVERY paycheck is save a set amount before you pay your bills or fund your lifestyle. I want you to make saving the first thing you and not the last thing you do.

Here is the simple approach I want you to adopt:

1. Pay Myself

2. Pay My Bills

3. Fund My Lifestyle

So, decide on an amount that you want to save each month and put that at the top of the budget. It may seem simple but choosing to contribute to your savings first means you won’t be saving what is leftover after you pay your bills and enjoy life. Instead you’ll be prioritizing saving and investing in your future self. Whether that’s the house you want to buy in a year, building an emergency fund so you’re prepared for unexpected expenses, or paying cash for a vacation to Hawaii.

Not sure if this is something you can do? My clients thought so too, and look at their results after adopting this approach:

Take Kristen, who was able to start saving $1430 a month. She is using this money to build her emergency fund, save for vacations, and save for a downpayment on a home.

Or Maggie, who went from saving nothing to saving $1000 a month, which allowed her to build her emergency fund and pay cash for a vacation.

Or Thu, who started saving over $1000 a month to finish building her emergency fund. Once that’s funded, she’ll shift this savings to another financial goal.

You may be thinking, that is great for them but you don’t know my situation. I can’t save monthly!

Take a deep breath because you can do this. We are focused on a simple shift so you can start small. The goal here is to make sure you’re paying yourself first whether that be $5, $25, $100, or $300 a month. We can chat about ways to increase that amount later.

For now, all you need to do is adopt this approach and start saving first so we can make your savings consistent and non-negotiable. Email me at keina@wealthovernow.com and tell me what amount you are going to pay yourself next month.

XOXO,

Keina