One of my favorite ways to support clients is by helping them make a plan to spend less or stay within their budget. When we’re looking at spending less, the common area that most of my clients need support is keeping their groceries or eating out budget under control. I’m fairly confident that this will resonate with you too. You’ve decided you only want to spend $xxx on food but you find yourself going over every week!

Today, I’m sharing with you three ways I support my clients in spending less using your food expenses as an example.

1. Break Down Your Monthly Budget

My current grocery budget is about $350 a month but I try and stick to about $75 per week. There are weeks I go over or under that amount but I use my weekly number of $75 to help me proactively manage my budget.

And here’s the best part you don’t have to shop the bargain aisle to make $75 a week work and your fridge won’t be bare just because you chose to live life on a budget. If you watch my Instagram stories, you know I’m a Whole Foods and Trader Joe’s aficionado and yes, I can get out of Whole Foods spending less than $75 because I have a plan for every dollar I spend.

Make It Personal: Take your monthly grocery budget and divide it by 4. Use this number to decide how much money you can spend each week on groceries.

2. Plan Ahead

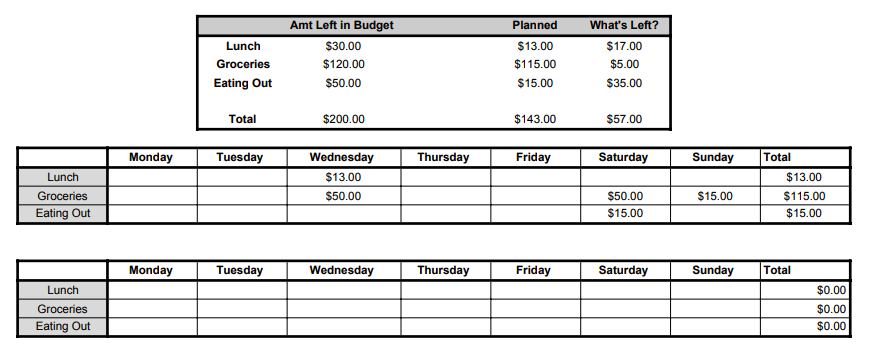

Planning ahead is the holy grail of budgeting and it can really help you reel in your spending on big expense categories like food. When I’m working with clients, I like to call it “visualizing expenses.” If you know you have $120 for groceries for the week, $30 for lunch at work, and $50 to spend on eating out you can build a plan from there for the week.

Using the example above, I’ll show you how I work through this with clients and how you can use this as a tool as well. Walkthrough every day of the week. Decide which days you’re buying lunch and how much you’ll spend. Do the same for groceries and eating out. You can then add up how much you plan to spend to ensure that the amount is in alignment with what you set aside in your budget.

Make It Personal: Make a plan for the upcoming week using the money you know you’re budgeting for food or a similar expense. Determine which day and how much you’ll spend each day. Consider days that you’ll know you’ll be grabbing dinner with a friend or days you know won’t be paying for lunch because you have a business lunch at work. Be sure you know the difference between the amount you have budgeted and the amount you’re planning to spend so not to go below zero.

3. Find Creative Ways to Save

If you’re trying to reduce your overall expenses find creative ways to save on categories in your budget. To reduce the amount you spend on eating out, you might invite friends over for shared dining where everyone brings a dish. Or you might decide to only eat out for lunch or dinner but not both. If you want to reduce the amount you’re spending on food, you can also commit to meal prepping. Meal prepping is a great way to reduce your food expenses.

Make It Personal: Look for creative ways to save money on common areas that you overspend. You can use one of the creative ways I shared or find your own.

These are my quick tips on how to spend less and stay within your budget. What do you do to help you stay within your budget when it comes to big categories like food? Send me an email at keina@wealthovernow.com and let me know.

P.S. I can’t believe I didn’t tell you about this last tip! Something else I’ve done to make cooking fun, add variety in my life, and save money is weekly meal prep with a friend. We would plan out 3-4 meals for the week, head to the store together, split the bill, and spend our Sunday prepping for the week. This was also a great way to nurture my quality time love language.